Pictet Group

Horizon 2023

Thorough research, robust frameworks and extensive experience are critical to inform long-term investment decisions. This is what Horizon is truly about.

Editorial by Alexandre Tavazzi and César Pérez Ruiz

-

Alexandre Tavazzi

Head of CIO Office & Macro Research

Pictet Wealth Management -

César Pérez Ruiz

Head of Investments & CIO

Pictet Wealth Management

Dealing with scarcities

This is the 11th year that we publish our 10-year return projections for various asset classes in Horizon. While the range of asset classes we cover has grown over time, we can now see how accurate were the forecasts we made back in 2013. Without wishing to blow our own trumpet too much, we are happy to report that we were not too far off the mark in many instances (see article ‘A respectable scorecard’).

We are also satisfied that some of the major themes we highlighted in previous editions of Horizon have indeed moved to the top of the strategic investment agenda. The signature theme of last year’s edition, ‘The return of big government’, has since gained further in relevance as we watch states throughout the world wrestle with unprecedented energy and security challenges. Indeed, the centrepiece of this year’s edition – scarcity – can be seen as an extension of this theme.

In our report, we look at what various forms of scarcity mean for strategic investment decisions. The most obvious scarcity concerns energy resources and commodities. Over the past year, Europe has shown an impressive ability to quickly overcome the cutting off of natural gas supplies from Russia. But it remains to be seen whether it can repeat this feat should conditions next winter prove more extreme than in 2022–2023. In addition, the ending of dependency on Russian gas has been replaced by dependency on gas from other sources. And in the global scheme of things, there is the risk that Peter is being robbed to pay Paul – in other words, that finite gas supplies will go primarily to rich European countries able to pay inflated prices, leaving poorer countries to do without. The same could prove true in other areas where geopolitics is complicating matters. We already see rich countries scrambling to secure difficult-to-exploit rare earths and corner access to state-of-the-art semiconductors.

(...) Continue reading

10 essential messages

Secular outlook

-

1. Scarcity of natural resources and labour will weigh on growth potential

Increasing competition for natural resources and the drop in working-age populations across most major economies will be major issues in the next 10 years. Scarcities of these sorts will affect economic growth potential and put upward pressure on inflation.

-

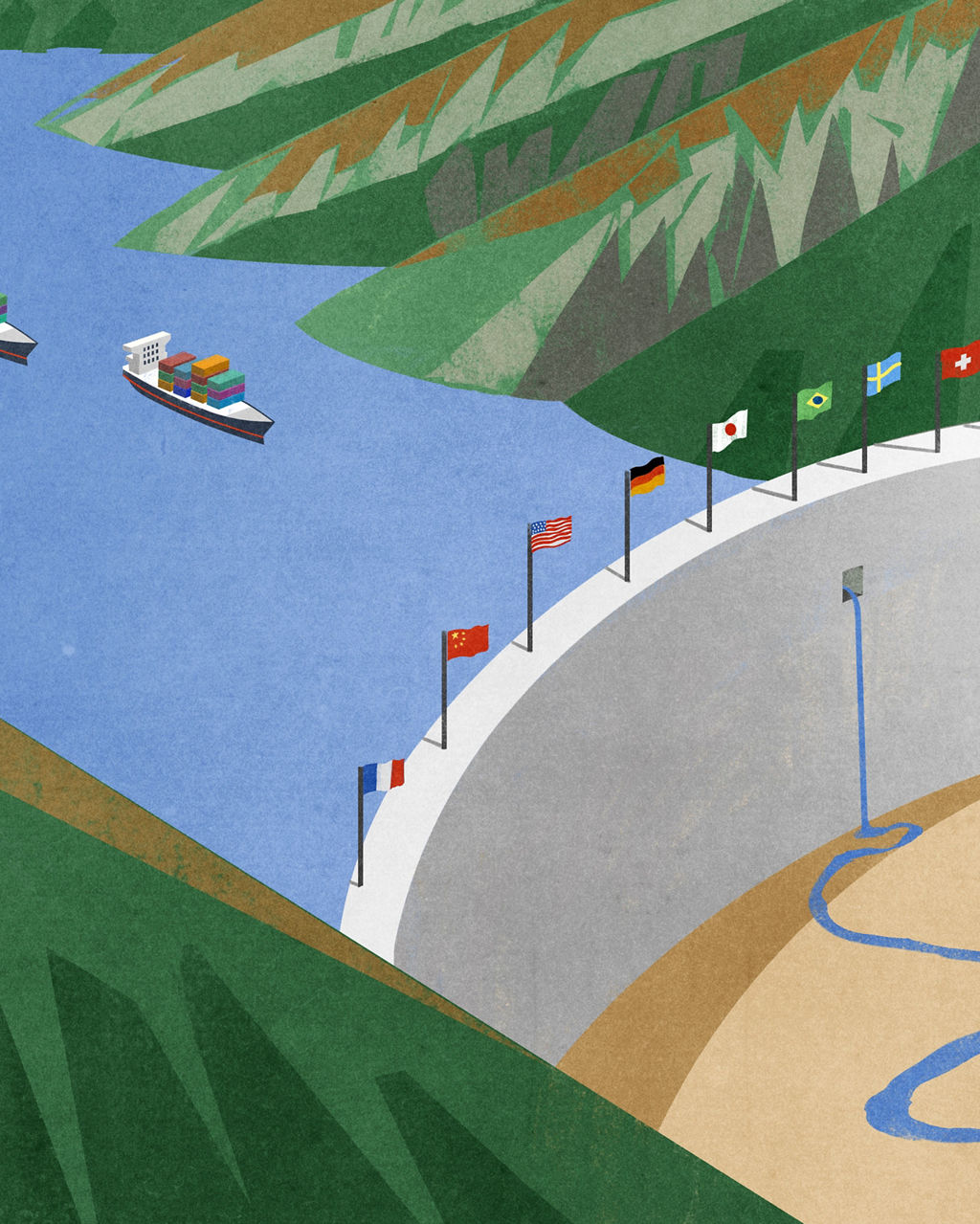

2. From monetary dominance to geopolitical dominance

After years of policy experiments and activism, we believe the significance of central banks to the global economy will be dwarfed by an increasingly fraught geopolitical environment marked by decoupling, ‘friend-shoring’ and strategic rivalry.

-

3. Higher inflation is the new normal

While the post-covid surge in prices is in the process of being unwound, we believe that inflation will remain structurally higher than before the pandemic as a result of demographic changes, the cost of the energy transition, tensions in raw material prices and the increased importance accorded to supply security.

-

4. We expect a new style of monetary policy

We foresee a new style of monetary policy making, one in which central banks will need to make a clear distinction between two objectives: ensuring financial stability (with potential interventions in the financial system) and ensuring price stability (thus keeping rates relatively high). We expect central banks to pursue these objectives in parallel.

Expected returns

-

5. Real returns from cash are set to turn positive in some places

After years of negative rates, the interest rate offered on cash deposits has been rising again, thanks to central banks’ aggressive fight against inflation. More interestingly, the real rates (after inflation) to be earned from cash and cash-like instruments is turning positive. Cash could therefore again be considered an asset class in its own right than a place simply to park money before seizing other investment opportunities.

-

6. Fixed income to provide decent carry again

We believe bond yields will be higher than in recent years as above-target inflation obliges central banks to maintain a tough policy stance. We believe the steep increase in bond yields since 2022 represents a regime shift and is unlikely to be fully reversed. We therefore forecast long-term government bonds in developed-markets (except Japan) to continue to offer handsome positive carry.

-

7. Corporate margins will come under increasing pressure

The capital expenditures involved in securing supply chains, the chance that workers gain the upper hand against management and the overall cost of ‘de-globalisation’ will play a role in pushing corporate margins down in the coming 10 years. Interest rates and taxes are other factors pushing in this direction. We believe corporations will really begin to feel the effect of central banks’ rate-hiking campaigns on their funding costs in 2024. Corporations will also face increasing tax pressure. The decline in margins is factored into our return expectations for developed-market equities. Our forecast is that margins will suffer more in the US than in Europe.

Strategic asset allocation

-

8. Private debt’s prospects will improve after central banks’ hiking cycle

We remain convinced that private debt has the potential to make an important contribution to the diversification of strategic asset allocations. We believe private lending by non-banks is set to increase – in part because of the recent turmoil in us regional banking and in part because of the scope for nonbanks willing to hold loans over the long term to extend lending tailored to borrowers’ specific needs. Over the past year and more, private credit has already shown its resilience in the face of inflation and rising interest rates.

-

9. The endowment style of investing retains its potential

The endowment style of investing is characterised by a focus on the pursuit of superior long-term returns and an ability to tolerate significant short-term volatility. This involves significant investments in alternatives at the expense of more liquid instruments like stocks and bonds. While they were not unaffected, the exposure of US endowment funds to alternatives cushioned the performance of US endowment funds in 2022, a difficult year for financial markets in general. We expect that an endowment approach will stand investors to good stead in the years ahead in a climate marked by higher interest rates and inflation than before.

-

10. The risks to our economic and asset return forecasts are set to increase

The dispersion of returns between assets and within asset classes like equities may be a ‘good thing’ for active investors. Dispersion may increase as central banks step back and unwind their securities holdings. The alpha opportunities to be had from identifying the winners and losers during such dispersion could well grow. But while there are ways to embrace uncertainty, the pace of change in economies and markets makes forecasting more fraught than ever.

A respectable scorecard

Our forecasts 10 years ago for a range of asset classes proved to be not too far from the mark.

Legal information and disclaimers

Distributors: Banque Pictet & Cie SA, Route des Acacias 60, 1211 Geneva 73, Switzerland and Bank Pictet & Cie (Europe) AG, Neue Mainzer Str. 1 60311 Frankfurt am Main Germany.

Banque Pictet & Cie SA is established in Switzerland, exclusively licensed under Swiss Law and therefore subject to the supervision of the Swiss Financial Market Supervisory Authority (FINMA). Bank Pictet & Cie (Europe) AG is established in Germany, authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht, the German Federal Financial Supervisory Authority (Bafin).

This marketing communication is not intended for persons who are citizens of, domiciled or resident in, or entities registered in a country or a jurisdiction in which its distribution, publication, provision or use would violate current laws and regulations.

The information, data and analysis furnished in this document are disclosed for information purposes only. They do not amount to any type of recommendation, either general or tailored to the personal circumstances of any person. Unless specifically stated otherwise, all price information is indicative only. No entity of the Pictet Group may be held liable for them, nor do they constitute an offer or an invitation to buy, sell or subscribe to securities or other financial instruments. The information contained herein is the result neither of financial analysis within the meaning of the Swiss Bankers Association’s Directives on the Independence of Financial Research, nor of investment research for the purposes of the relevant EU MiFID provisions. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness.

Except for any obligations that any entity of the Pictet Group might have towards the addressee, the addressee should consider the suitability of the transaction to individual objectives and independently assess, with a professional advisor, the specific financial risks as well as legal, regulatory, credit, tax and accounting consequences.

Furthermore, the information, opinions and estimates in this document reflect an evaluation as of the date of initial publication and may be changed without notice. The Pictet Group is not under any obligation to update or keep current the information contained herein. In case this document refers to the value and income of one or more securities or financial instruments, it is based on rates from the customary sources of financial information that may fluctuate. The market value of financial instruments may vary on the basis of economic, financial or political changes, currency fluctuations, the remaining term, market conditions, the volatility and solvency of the issuer or the benchmark issuer. Some investments may not be readily realizable since the market in the securities can be illiquid. Moreover, exchange rates may have a positive or negative effect on the value, the price or the income of the securities or the related investments mentioned in this document. When investing in emerging countries, please note that the political and economic situation in those countries is significantly less stable than in industrialized countries. They are much more exposed to the risks of rapid political change and economic setbacks.

Past performance must not be considered an indicator or guarantee of future performance, and the addressees of this document are fully responsible for any investments they make. No express or implied warranty is given as to future performance. Moreover, forecasts are not a reliable indicator of future performance. The content of this document can only be read and/or used by its addressee. The Pictet Group is not liable for the use, transmission or exploitation of the content of this document. Therefore, any form of reproduction, copying, disclosure, modification and/or publication of the content is under the sole liability of the addressee of this document, and no liability whatsoever will be incurred by the Pictet Group. The addressee of this document agrees to comply with the applicable laws and regulations in the jurisdictions where they use the information reproduced in this document.

This marketing publication is issued by Banque Pictet & Cie SA. This marketing publication and its content may be cited provided that the source is indicated.

All rights reserved. Copyright 2023.

Distributor: Bank Pictet & Cie (Europe) AG, London branch (“Pictet London Branch”)

This is a marketing communication distributed by Pictet London Branch.

This document sets forth neither a personal recommendation tailored to the needs, objectives and financial situation of any individual or company (investment advice as defined in the Financial Conduct Authority’s Handbook of rules and guidance (the “FCA Handbook”)), nor the results of investment research within the meaning of the FCA Handbook. Moreover, it does not constitute an offer, or an invitation to buy, sell or subscribe to securities or other financial instruments, nor is it meant as a proposal for the conclusion of any type of agreement. Furthermore, this document should not be considered a suitability report as Pictet London Branch has not received all the necessary information on the recipient to complete its suitability assessment that covers the recipient’s knowledge and experience, tolerance to risk, sustainability preferences, if any, investment needs and the recipient’s ability to absorb financial risk. Should its addressee decide to proceed to any transaction in relation to a financial product referred to herein, this will be in his sole responsibility, and the suitability/appropriateness of the transaction and other financial, legal and tax aspects should be assessed by an expert.

Any information contained in this document is disclosed for information purposes only, and neither the producer nor the distributor can be held liable for any fluctuation of the price of the securities. No express or implied warranty is given as to future performance. The opinions expressed reflect an objective evaluation of information available to the general public, such as rates from customary sources of financial information. The market value of securities mentioned may vary on the basis of economic, financial or political changes, the remaining term, market conditions, the volatility and solvency of the issuer or the benchmark issuer. Moreover, exchange rates may have a positive or negative effect on the value, the price or the income of the securities or the related investments mentioned in this document. It is also expressly noted that forecasts are not a reliable indicator of future performance, while past performance is not a reliable indicator of future results.

You shall only take investment decisions when you fully understand the relevant financial product and the involved risks. In particular, the relevant product documentation (such as the issuance program, final terms, prospectus, simplified prospectus and key (investor) information document), as well as Appendix 4: Risk Warnings Relating to Trading in Financial Instruments of the Terms and Conditions of Pictet London Branch, shall be read. Structured products are complex financial products and involve a high degree of risk. The value of structured products depends not only on the performance of the underlying asset(s), but also on the credit rating of the issuer. Furthermore, the investor is exposed to the risk of default of the issuer/guarantor.

In respect of any product documentation, including key information documents of Packaged Retail and Insurance-based Investment Products (“KIDs”), please note that these may change without notice. You should therefore ensure that you review the latest version of them prior to confirming to Pictet London your decision to invest. If you have been provided with a link to access the respective KID/other product document, you should therefore click on the link immediately before confirming to Pictet London Branch your decision to invest, in order to review the most recent version of the respective KID/other product document. If you have not been provided with a link to access the relevant document, or if you are in any doubt as to what the latest version of the respective KID/other product document is, or where it can be found, please ask your usual Pictet London Branch contact.

Pictet London Branch is not the manufacturer of the product(s) and the KID/other product document is provided by a third party. The KID/other product document is obtained from sources believed to be reliable. Pictet London Branch does not make any guarantee or warranty as to the correctness and accuracy of the data contained in the KID/other product document. Pictet London Branch may not be held liable for an investment decision or other transaction made based on reliance on, or use of, the data contained in the KID/other product document.

By subscribing to the product(s) proposed herein, you acknowledge that you have (i) received, in good time, read and understood any relevant documentation linked to the product(s), including, as the case may be, the respective KID/other product document; (ii) taken note of the product(s) restrictions; and (iii) meet the applicable subjective and objective eligibility conditions to invest in the product(s).

Pictet London Branch may, if necessary, rely on these acknowledgements and receive your orders, to transmit them to another professional, or to execute them, according to the relevant clauses of your mandate, as well as the Terms and Conditions of Pictet London Branch.

The content of this document shall only be read and/or used by its addressee. Any form of reproduction, copying, disclosure, modification and/or publication in any form or by any means whatsoever is not permitted without the prior written consent of Pictet London Branch and no liability whatsoever will be incurred by Pictet London Branch. The addressee of this document agrees to comply with the applicable laws and regulations in the jurisdictions where they use the information provided in this document.

Pictet London Branch is a branch of Bank Pictet & Cie (Europe) AG. Bank Pictet & Cie (Europe) AG is a credit institution incorporated in Germany and registered with the Handelsregister, the German Commercial Register under the no. HRB 131080. Its head office is at Neue Mainzer Str. 1, 60311 Frankfurt am Main, Germany. Bank Pictet & Cie (Europe) AG is authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht, the German Federal Financial Supervisory Authority (BaFIN)

Pictet London Branch is registered as a UK establishment with Companies House (establishment number BR016925) and its UK establishment office address is Stratton House, 6th Floor, 5 Stratton Street, London W1J 8LA. Authorised by the Prudential Regulation Authority (PRA) and subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request.

Distributors: Bank Pictet & Cie (Asia) Ltd (“BPCAL”) in Singapore and/or Banque Pictet & Cie SA, Hong Kong Branch (“Pictet HK Branch”) in Hong Kong.

The information, tools and material presented in this document are provided for information purposes only and are not to be used or considered as an offer, an invitation to offer or solicitation to buy, sell or subscribe for any securities, commodities, derivatives, (in respect of Singapore only) futures, or other financial instruments (collectively referred to as “Investments”) or to enter into any legal relations, nor as advice or recommendation with respect to any Investments. This document is intended for general circulation and it is not directed at any particular person. This document does not have regard to the specific investment objectives, financial situation and/or the particular needs of any recipient of this document. Investors should seek independent financial advice regarding the appropriateness of investing in any Investments or adopting any strategies discussed in this document, taking into account the specific investment objectives, financial situation or particular needs of the investor, before making a commitment to invest.

BPCAL/Pictet HK Branch has not taken any steps to ensure that the Investments referred to in this document are suitable for any particular investor, and accepts no fiduciary duties to any investor in this regard, except as required by applicable laws and regulations. Furthermore, BPCAL/Pictet HK Branch makes no representations and gives no advice concerning the appropriate accounting treatment or possible tax consequences of any Investment. Any investor interested in buying or making any Investment should conduct its own investigation and analysis of the Investment and consult with its own professional adviser(s) as to any Investment including the risks involved.

This document is not to be relied upon in substitution for the exercise of independent judgment. The value and income of any Investment mentioned in this document may fall as well rise. The market value may be affected by, amongst other things, changes in economic, financial, political factors, time to maturity, market conditions and volatility, and the credit quality of any issuer or reference issuer. Furthermore, foreign currency rates of exchange may have a positive or adverse effect on the value, price or income of any Investment mentioned in this document. Accordingly, investors must be willing and able to assume all risks and may receive back less than originally invested.

Past performance should not be taken as an indication or guarantee of future performance and no representation or warranty, expressed or implied, is made by BPCAL/Pictet HK Branch regarding future performance.

This document does not constitute the investment policy of BPCAL/Pictet HK Branch, or an investment recommendation, and merely contains the different assumptions, views and analytical methods of the analysts who prepared them. Furthermore, the information, opinions and estimates expressed herein reflect a judgment at its original date of publication and are subject to change without notice and without any obligation on BPCAL/Pictet HK Branch to update any of them. BPCAL/Pictet HK Branch may have issued or distributed other reports or documents that are inconsistent with, and reach different conclusions from, the information presented in this document.

While the information and opinions presented herein are from sources believed to be reliable, BPCAL/Pictet HK Branch is not able to, and do not make any representation or warranty as to its accuracy or completeness. Accordingly, BPCAL/Pictet HK Branch accepts no liability for loss arising from the use of or reliance on this document presented for information purposes only. BPCAL/Pictet HK Branch reserves the right to act upon or use any of the information in this document at any time, including before its publication herein.

BPCAL/Pictet HK Branch and its affiliates (or employees thereof) may or may not have long or short positions in, and buy or sell, or otherwise have interest in, any of the Investments mentioned herein, and may or may not have relationships with the issuers of or entities connected with Investments mentioned in this document. BPCAL/Pictet HK Branch and their affiliates (or employees thereof) may act inconsistently with the information and/or opinions presented in this document.

The information used to prepare this document and/or any part of such information, may have been provided or circulated to employees and/or one or more clients of BPCAL/Pictet HK Branch before this document was received by you and such information may have been acted upon by such recipients or by BPCAL/Pictet HK Branch.

This document is provided solely for the information of the intended recipient only and should not be reproduced, published, circulated or disclosed in whole or in part to any other person without the prior written consent of BPCAL/Pictet HK Branch.

Singapore

This document is not directed to, or intended for distribution, publication to or use by, persons who are not accredited investors, expert investors or institutional investors as defined in section 4A of the Securities and Futures Act 2001 (“SFA”) or any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject BPCAL and any of its affiliates or related corporations to any prospectus or registration requirements.

BPCAL is a wholesale bank regulated by the Monetary Authority of Singapore (“MAS”) under the Banking Act 1970 of Singapore, an exempt financial adviser under the Financial Advisers Act 2001 of Singapore (“FAA”) and an exempt capital markets licence holder under the SFA. Please contact BPCAL in Singapore in respect of any matters arising from, or in connection with this document.

Hong Kong

This document is not directed to, or intended for distribution, publication to or use by, persons who are not “professional investors” within the meaning of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) and any rules made thereunder (the “SFO”) or any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject Pictet HK Branch and any of its affiliates or related corporations to any prospectus or registration requirements. If you do not want Pictet HK Branch to use your personal information for marketing purposes, you can request Pictet HK Branch to stop doing so without incurring any charge to you.

In distributing an investment product as agent for a third party service provider, Pictet HK Branch distributes the product for the third party service provider and the product is a product of the third party service provider but not Pictet HK Branch. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Pictet HK Branch and you out of the selling process or processing of the related transaction, Pictet HK Branch is required to enter into a Financial Dispute Resolution Scheme process with you; however any dispute over the contractual terms of the product should be resolved directly between the third party service provider and you.

Banque Pictet & Cie SA is a limited liability company incorporated in Switzerland. It is an authorized institution within the meaning of the Banking Ordinance and a registered institution (CE No.: BMG891) under the SFO carrying on Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. The registered address of Pictet HK Branch is 9/F., Chater House, 8 Connaught Road Central, Hong Kong.

Warning: The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. Please contact Pictet HK Branch in Hong Kong in respect of any matters arising from, or in connection with this document.

Distributor: Pictet Bank & Trust Limited, where registered office is located at Building 1, Bayside Executive Park, West Bay Street & Blake Road, Nassau, New Providence, The Bahamas.

The document is not directed to, or intended for distribution or publication to or use by persons who are not Accredited Investors (as defined in the Securities Industry Regulations, 2012) and subject to the conditions set forth in the Securities Industry Regulations, 2012 or to any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or would subject Pictet Bank & Trust Limited to any prospectus or registration requirements. Pictet Bank & Trust Limited is incorporated in The Bahamas with limited liability. It is a bank and trust company that is licensed in accordance with the Banks and Trust Companies’ Regulation Act and is regulated by the Central Bank of The Bahamas. Additionally, Pictet Bank & Trust Limited is registered with the Securities Commission of The Bahamas as a Broker Dealer II and is approved to (i) Deal in Securities 1.(a) & (c ); (ii) Arrange Deals in securities; (iii) Manage Securities ; (iv) Advise on Securities.

Warning: The content of this document has not been reviewed by any regulatory authority in The Bahamas. You are, therefore, advised to exercise caution when processing the information contained herein. If you are in any doubt about any of the content of this document, you should obtain independent professional advice.